The financial industry can be difficult to navigate, which is why innovative solutions are so important. Financial software development services offer a wide range of options to meet users’ needs, including advanced analytics platforms and robust accounting systems.

FinTech is more than just merging financial services with technology – it’s about creating an ecosystem that prioritises timely, convenient, and customer-focused transactions.

FinTech architecture is designed to solve age-old problems in the sector with digital-first solutions. This has led to a significant increase in businesses entering the space.

If you’re one of those businesses, you’re in the right place. We have created this guide to help you enter and succeed in the FinTech space. It will give you all the information you need to get started.

What is Financial Software Development?

Financial software development is the process of generating a wide range of solutions for banking, stock trading, day-to-day financial activities, etc.

The scope of software development finance is enormous, encompassing everything from simple budgeting applications to complicated trading platforms.

This programme attempts to improve the efficiency of financial institutions and organisations by optimising their operations, improving informed decision-making, and eventually generating more profits.

Financial technology is a rapidly expanding field with several applications. Some of the most popular types of financial software systems are:

- Apps for making payments and transferring money

- Investment applications

- Apps for lending and borrowing money

- Accounting applications

- Apps for Decentralised Finance (DeFi)

- Cryptocurrency apps

- Insurance applications

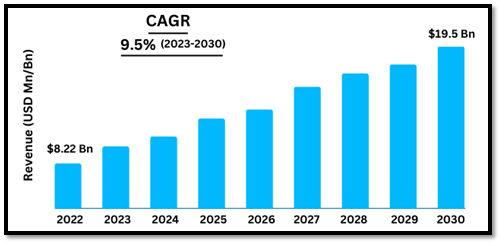

The Growth and Potential of Global Fintech Market

- The global financial market is expected to reach USD 29.2 trillion by 2024, up from USD 24.9 trillion in 2023.

- The global financial market is expected to generate USD 13.6 trillion in revenue in 2024, up from USD 12.3 trillion in 2023.

- The asset management market is expected to reach a size of USD 7.8 trillion by 2024.

- The investment banking market is expected to generate USD 2.1 trillion in revenue in 2024.

- The commercial banking market is expected to reach a size of USD 11.3 trillion by 2024.

The Benefits of Utilising Financial Software Development Solutions

Financial software has become crucial in today’s digital-first world. It enables everything from mobile banking apps to high-frequency stock trading systems.

Here are some of the most essential reasons why financial software is so crucial:

Automation

Software development can automate repetitive manual procedures, lowering costs and increasing productivity. This covers loan processing, claims administration, compliance reporting, and other tasks.

Portability

Through mobile and internet connectivity, applications and online platforms provide access to software for financial services anytime and anywhere.

Safety

Software for financial institutions incorporates strong security mechanisms such as encryption, access limits, and fraud monitoring to protect sensitive client data.

Data-Driven Insights

By combining and analysing financial data, a custom software discovers hidden trends and delivers data-backed suggestions to consumers and organisations.

Customisation

Financial software uses data to deliver specific recommendations and features to each consumer for a seamless experience.

Flexibility and Scalability

Cloud-based financial software might scale on demand to accommodate changes in transaction volumes and user traffic. As financial services continue to digitise, custom software will be required to maintain a competitive advantage.

To fulfil escalating customer expectations, both established institutions and innovative fintech firms must invest in next-gen custom financial software development.

The Top Fintech Software Development Trends For 2024

Financial software is quickly evolving, with new technology and business models appearing on a regular basis.

These best financial services software trends are revolutionising important sectors such as banking, investing, insurance, etc.

Open Banking

Open banking and finance software has transformed the way data is exchanged between banks and third-party companies.

This transition allows financial service providers to have access to banking data and develop new and creative goods and services, such as improved personal finance management tools and more accessible loans.

Artificial Intelligence (AI)/Machine Learning (ML)

Fintech organisations are using artificial intelligence and machine learning to automate operations, improve client experiences, and detect fraudulent activity.

AI in financial software development can process massive volumes of data and deliver insights that people might overlook.

Embedded Finance

Embedded finance is the integration of financial services into websites or mobile apps. This allows you to access financial services without leaving the platform.

For example, you may simply access your banking app or make purchases while using an eCommerce app. That is the perfect illustration of embedded finance.

Large-Scale Data and Analytics

In recent years, big data and analytics have transformed the financial business.

With the growing availability of data, organisations may now use advanced analytics to make more informed financial decisions. You may also use this trend in custom financial software development.

Using big data and analytics, you may analyse customer behaviour, market trends, and your company’s previous financial data. All of this helps you discover unique possibilities and potential threats.

Blockchain Technology in Finance

Blockchain is used in various financial applications, from powering Bitcoin transactions to expediting trade financing.

Decentralised finance (DeFi) platforms built on blockchain offer crypto-based financial services without intermediaries.

Banking as a Platform (BaaP)

BaaP enables non-bank companies to use APIs to incorporate banking features such as accounts, payments, and card issuance into their own apps and products. This makes financial services more accessible.

Cloud-Based Financial Software

Cloud integration services, or SaaS, are increasingly gaining popularity in the banking software development services industry. Because finance deals with massive data, transactions, and people, managing such a gigantic system using the traditional technique is impractical.

Furthermore, cloud integration and migration services make it simple to migrate your data to a distant server. This allows you to get the benefits of fast processing and next-generation technology while protecting your data from natural catastrophes and thefts.

Key Features of Financial Services Software Development

Financial services software solutions are intended to give customers various solid tools and features to assist them in better managing their finances.

The following features and functions establish financial software services as an efficient instrument for managing and improving financial operations:

- Safe authentication and authorisation

- Real-time Notifications and updates

- Personalised Dashboards and user interfaces

- Tools for customised financial management

- Advanced data analytics and reporting capabilities

- Effortless integration with third-party financial services and APIs

- Automated transaction processing and record-keeping

- User-centric design and cross-platform compatibility

Technological Stack for Fintech software Development Solutions

The technological stack used for financial technology development might vary based on the needs of the project.

The below table will give you an idea on various technologies may need to be installed:

| Tech Stack Component | Mobile Development | Web Development |

| Front-end | React Native, Flutter, Kotlin Native, Swift | React, Angular, Vue.js |

| Back-end | Node.js, Java, Python | Node.js, Java, Python |

| Database | MongoDB, PostgreSQL, SQLite | PostgreSQL, MySQL |

| Cloud Platform | AWS, Azure, Google Cloud Platform | AWS, Azure, Google Cloud Platform |

| Security | OAuth, JWT, OWASP Top 10 | JWT, OWASP Top 10 |

| DevOps | Git, Jenkins, Docker, Kubernetes | Git, Jenkins, Kubernetes |

Finacial Software Development: A Step-By-Step Process

Generating and Validating Ideas

The first step includes brainstorming and determining the viability of a fintech project.

Project Initiation and Requirements Analysis

Throughout this stage, we discuss project objectives, needs, and timescales to design a tech-driven finance development plan.

Design and Prototyping

During this stage, the main focus is on creating user interface designs and building prototypes to ensure that the fintech solution is functional and user-friendly.

Software Development and Testing

Developers extensively write and test the code to ensure the solution performs as expected.

Launching and Support

The deployment of the fintech product to the market and its ongoing maintenance is the primary focus of this stage.

Continuous Support and Maintenance

This stage involves continuous support, upgrades, and maintenance services for the completed product throughout its entire lifecycle.

The Cost of Fintech Software Development Solutions

The average cost of finance software development in Australia ranges from $20,000 to $100,000.

However, the actual cost of fintech software development solutions varies depending on several factors.

App Complexity

The complexity of the fintech app, encompassing features, functionalities, and integrations, plays a significant role in determining development costs.

Simpler apps with basic functionalities will incur lower prices compared to advanced solutions with advanced features and integrations.

Technology Stack

The choice of technologies employed for development significantly impacts costs.

Open-source technologies often offer cost-effective solutions, while proprietary technologies may involve higher licensing fees.

Team Experience and Location

The experience level of the development team and their location within Australia can influence costs.

Senior developers with extensive experience may command higher rates, while developers with less experience may charge less.

Project Scope and Timeline

The scope of the project, encompassing the number of features, integrations, and platforms, directly affects software development costs.

A larger scope with a more extended timeline will typically incur higher costs.

How to Find the Right Fintech Software Development Company?

Choosing the right company for software development financial services can be a challenging task.

To make sure you select the best option, consider factors such as a company’s expertise in financial technology, their portfolio of previous work, and their ability to communicate effectively.

Take your time, ask the right questions, and do thorough research before making a decision.

When selecting a finance software development company, there are several factors to consider:

- Review their portfolio to assess their experience in developing web, mobile, and back-end systems.

- Look for companies with proven expertise in blockchain, AI, and cloud infrastructure.

- Inquire about their compliance with financial regulations and security best practices.

- It is important to evaluate their communication channels, project management, and wealth management software development methodology.

- Discuss post-launch support for bug fixes, maintenance, and new features.

- Compare project timelines, budget estimates, and engagement models such as fixed cost, time & material, and dedicated team.

- Opt for companies with fintech developers that hold relevant certifications.

- Check client reviews and feedback for major financial software projects completed to ensure that the company has a track record of delivering quality work.

Conclusion

To navigate the landscape of wealth management software development in 2024, it is crucial to have a strategic blend of innovation, compliance, and user-centric design.

It is essential to embrace cutting-edge technologies while prioritising security and scalability. This guide illuminates the path, emphasising the need for adaptable solutions that cater to the evolving market needs.

Combining expertise with technological advancements is pivotal to developing robust financial software systems to stay ahead in this dynamic industry.

How Vrinsoft Can Assist with Your FinTech Project?

Vrinsoft Pty Ltd is the top financial software development company in Australia with over a decade of experience in both IT and financial services.

We specialize in providing top-notch software development services for financial institutions and have successfully assisted numerous businesses.

Our extensive experience enables our financial software developers to tackle any challenge and ensure the successful delivery of your app.

Contact us today to begin your financial services software development project.

FAQs on Financial Software Development

What are the emerging FinTech software development app trends?

The following are some of the emerging finance software development trends:

- Open Banking and Embedded Finance

- Artificial Intelligence and Machine Learning

- Blockchain and Decentralized Finance (DeFi)

- Cybersecurity and Data Privacy

- Cloud Computing and Infrastructure

How much does fintech software development cost?

The cost of fintech software development in Australia can vary depending on the complexity of the app, the features required, and the experience of the development team.

However, the average cost to develop fintech apps include:

| Feature | Cost |

| Basic fintech app | $10,000 – $50,000 |

| Medium-complexity fintech app | $50,000 – $250,000 |

| Complex fintech app | $250,000+ |

How long does it take to develop financial software?

The duration required for developing financial software solutions may vary depending on the complexity of the project, its scope, and the level of customization needed.

When considering the analysis, design, programming, testing, and deployment phases of the development lifecycle, it is possible that developing financial software may take anywhere from 4-5 months to a year or more on average.

How to find a financial software application development company?

When searching for a software development partner in financial services, it is important to consider their experience in the domain, past work on software products, the technology they use, and their price quote.